J Studios/DigitalVision by way of Getty Photos

Pricey traders,

I’m writing to provide you our quarterly replace on the Warfare Cap fund.

Please learn the disclaimer HERE – nothing right here is funding recommendation.

First efficiency – the quarter was up healthily at 4.57% over Q2, and YTD efficiency is now optimistic at 2.32%, vs 13.96% for the S&P and 4.77% for the REIT index. Since inception we’re at 196.66%, nonetheless outperforming the S&P and the REIT benchmark of 148.58% & 64.26%, respectively.

It’s price noting that because the 12 months has progressed the REIT index has change into a worse benchmark for us because the portfolio has diversified, however I’ll preserve it right here for continuity and as for the historic returns it stays a very good benchmark.

The explanation we’re solely up a little bit regardless of an enormous win in Plymouth Industrial (PLYM) & a bull market is that I’ve moved the portfolio to a really defensive positioning, with a big money steadiness and important quick positions. The shorts clearly haven’t taken off but because the markets proceed to notch all time highs.

And the explanation I’m so defensive is that I consider now we have entered a full blown mania stage of the cycle. The proof for that is in every single place you wish to look.

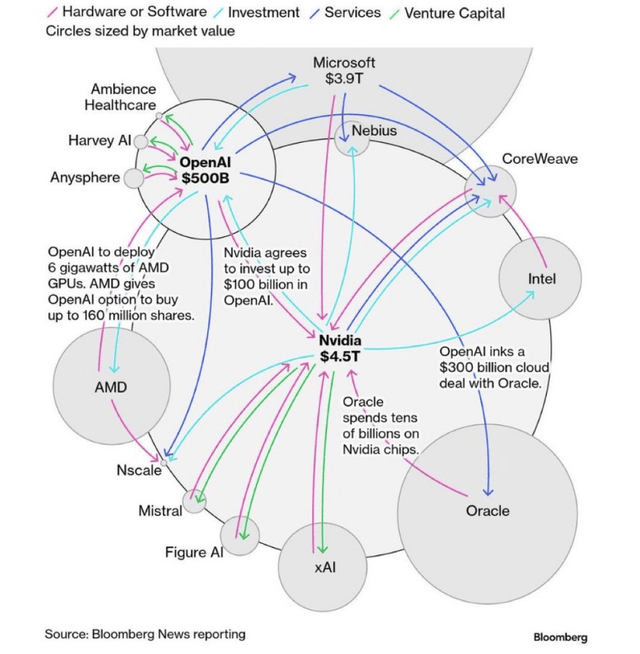

First and on the coronary heart of issues is the AI bubble, led by Nvidia (NVDA), Open AI and an online of round offers introduced in the previous couple of months. OAI has dedicated to spending over 1 trillion {dollars} over the subsequent a number of years in numerous chip and knowledge middle offers – a completely astronomical sum, particularly when you think about that OAI’s income is on tempo for one thing like $13 billion if firm projections are right (certainly the dedication is now most likely over $1.5 trillion after this mornings Broadcom (AVGO) announcement). This ratio can be wild sufficient if it weren’t for the truth that Open AI is dropping cash hand over first proper now – in H1 2025 they apparently made $4.3 billion and had losses of $7.8 billion!1

The one means OAI can come near assembly these spending bulletins is to lift large quantities of cash. Certainly OpenAI itself initiatives it is going to want properly over $100 billion in money by way of 2030 earlier than it begins to make cash – simply wild, wild projections. $100+ billion even mixed with revenues paying for some capex doesn’t get wherever near $1 trillion, so OAI’s projections would additionally require important funding by different events.

And but, the non-public market could also be starting to get some heartburn over OAI’s funding wants mixed with their money burn, as just lately we noticed that OAI has turned to its largest provider, Nvidia, for financing.

Nvidia introduced it could make investments $100 billion in OAI to fund knowledge middle construct outs – funds which might primarily be spent on Nvidia chips. We haven’t seen this sort of vendor financing because the dot com increase, and it’s a very unhealthy signal for my part. And its not simply Nvidia and OpenAI, these round relationships are rife within the AI area.

Easy and clear, proper?

Or, in layman’s phrases, one thing like this

Frankly the audacity of this deal shocked me, and it could delay the inevitable reckoning some time longer if Nvidia is prepared to wholesale fund the AI capex bubble. Nvidia is seemingly a lot much less involved about returns than most non-public traders are, since it is going to obtain most of its funding proper again within the type of chip purchases, and thus they could prolong the cycle by making investments the place different capital in any other case wouldn’t.

On Capital Expenditures and Obligatory Revenues

I wrote a bit in regards to the wanted revenues to make all of this capex work a bit again in February, however it’s price revisiting a bit now over half a 12 months later. AI Capex spending seems to be as much as a ~$400B annual run fee. I estimated it was extra like 200-250b earlier within the 12 months, and it was already fairly substantial in 2024 & even 2023, and might be if something increased in 2026 if the main gamers are to be believed (though I personally assume it begins to fall off in 26). However in the event you assume they’re proper and so we are saying ‘simply’ one other ~$400 billion in 2026, now we have roughly over $1 trillion in AI capex funding by way of 12 months finish 2026. At a 50% margin2, that wants $2 trillion in cumulative revenues to interrupt even3. This determine after all ratchets up each single 12 months as extra capex is spent. However even ignoring that vast problem, merely paying for the present batch of capex might be a completely large mountain to climb, simply to interrupt even!

Given the comparatively quick lifespan of GPUs (though admittedly different elements of the info facilities have an extended lifespan, however GPUs seem like the vast majority of spend) let’s imagine now we have by way of ~2030 to make this $2 trillion. So 5 years, or $400 billion a 12 months. For comparability your complete US software program market is one thing like $360 billion / 12 months. So the world wants so as to add one other America of software program spending, and it must do it within the subsequent 12 months. Clearly that isn’t going to occur – maybe finally at some point it is going to however the issue is we could have an entire era (or two !) of GPUs which can be a capital loss within the interim.

The AI enterprise itself is on observe (or was in July, in keeping with the Info’s reporting) for about $18.5B in income on the core massive AI startups, with the overwhelming majority of that being OAI and Anthropic. There’s a little bit of income elsewhere – lets generously assume its $25 B whole. So we want revenues to 16X simply to interrupt even! If these firms wish to really make some cash on their capex funding, multiply all these figures by 1.5 to 2x, or 24-32x.

Realistically, the one state of affairs by which that may occur is that if we really create a normal tremendous intelligence, and shortly. And based mostly on all the things I’m seeing, we’re simply not on observe for that. Mannequin enchancment has slowed down dramatically just lately – scaling started to sluggish final 12 months, after which reinforcement studying prolonged the ramp out additional into this 12 months. However the newest era of fashions merely usually are not that significantly better than their predecessors, one thing most clearly seen within the disappointing GPT 5 launch.

The place we’re seeing continued good enchancment is fields that are amenable to reinforcement studying (most notably coding), video era4, and in addition importantly in bringing the decrease price fashions nearer to the efficiency frontier (this final one bodes very poorly for good returns on stated capex). These are all vital, and make no mistake generative AI goes to be an enormous enterprise. However it merely can not justify the present capex spend, once more barring an AGI breakthrough.56

Many individuals noticed the early exponential enchancment and extrapolated that out into the long run till we hit AGI. The issue is that technological progress is commonly extra like a sequence of log or sigmoid curves, the place we expertise speedy development in sure areas solely to then decelerate dramatically, versus progress being one massive exponent. A very good instance of that is the ‘bodily sciences’, as a catch all time period for tech within the bodily world, again within the first half of the twentieth century. We went from horse calvary to nuclear vitality and touchdown on the moon in ~50 years, an astounding fee of progress, and so no shock the 50s and 60s have been stuffed with predictions that such progress would proceed and by 2020 we’d be a spacefaring civilization with flying vehicles, colonies on mars, and limitless vitality. Sadly these prior exponents didn’t proceed.

All proof I’m seeing so far is that we appear to be on an identical observe for AI. As a little bit teaser – I’m engaged on an AI product for monetary analysis (who doesn’t have an AI startup nowadays) with some pals within the tech world. I’m very excited to share it quickly, and I believe we could have one thing very helpful and funky once we launch in hopefully just a few months. However as a bonus this offers me a fairly good entrance line perspective on LLM progress and limitations, which provides me extra confidence in these predictions.

Bubbles throughout

It isn’t simply AI although, you possibly can see the mania all through the market. The most effective instance might be quantum computing shares (though nuclear shares are attempting to provide quantum a run for its cash). There are 4 publicly traded quantum computing shares with a present mixed market cap of ~$540 billion (really even increased at this time as of this writing by some means), in opposition to revenues of ~$100mm, or an insane 600x gross sales a number of (the companies after all don’t make any cash, so the PE will not be calculable). Quantum computing has no confirmed present functions, and the first utilization many consider is feasible, factoring very massive numbers to interrupt encryption, is many a few years out even when technological tempo continues at a really speedy tempo.7

So now we have an business which could start to serve a critical use case in 10+ years, buying and selling at a valuation that’s arguably increased than even the revenues from that use case may ever help, if stated revenues are even ever achieved! Simply insanity throughout. I consider quantum computing represents a superb shorting alternative, and have taken out quick positions on a number of of the quantum companies.

There are various extra examples – crypto and the proliferation of of crypto treasury firms is one other instance (though this one is cracking), quite a few public firms with enormous valuations and no income, new memestocks springing to life, hell even Chamath has raised one other SPAC!

In my opinion there isn’t any query we’re in a mania at this time, the one query is how lengthy can it final. I have no idea, but when historical past is any information at most one other 12 months to a 12 months and a half (though it may occur a lot sooner!). I beforehand guessed issues would start to unwind Q1 2026 as funding ran out for the AI capex increase, however Nvidia stepping in to fill the void could now push this again a number of quarters.

Coming Down

A associated query is, can the mania unwind with no recession? We simply lived by way of a profitable instance of this within the 2021 bubble and unwind thereafter, so it’s definitely potential. Nevertheless what frightens me is simply how slim the scope of this bubble is, and the way the remainder of the financial system appears to actually be softening. In distinction in 2022 we had the large upswing of the covid normalization bullwhip, the place many actual financial system sectors corresponding to journey & retail have been nonetheless recovering in an enormous means8. Not solely that, however the large enhance in development triggered by low charges and massive value will increase in 2021 was solely simply starting to hit the actual financial system in 2022. This offered a multiyear stimulus that has solely simply started to put on off.

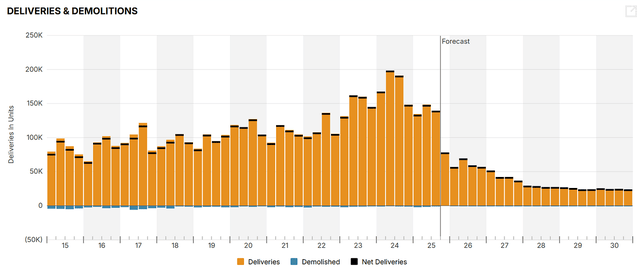

The truth is in the event you have a look at nationwide multifamily deliveries, we will see that development is about to fall off a cliff within the subsequent few months. These employees are going to roll off their present jobs into an financial system with extraordinarily restricted new development outdoors of information facilities, and really restricted hiring wherever.

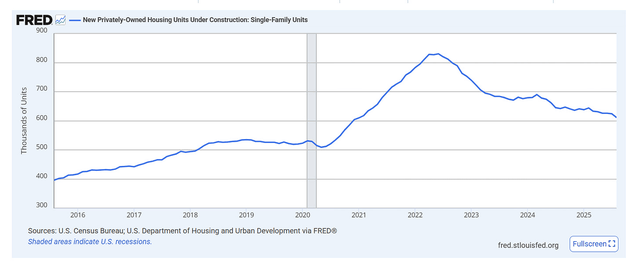

However it’s not simply multifamily. Single household housing, an enormous driver of GDP, is seeing main cracks unfold throughout lots of the increase markets.

Single household development has declined dramatically – right here is FRED’s single household models beneath development.

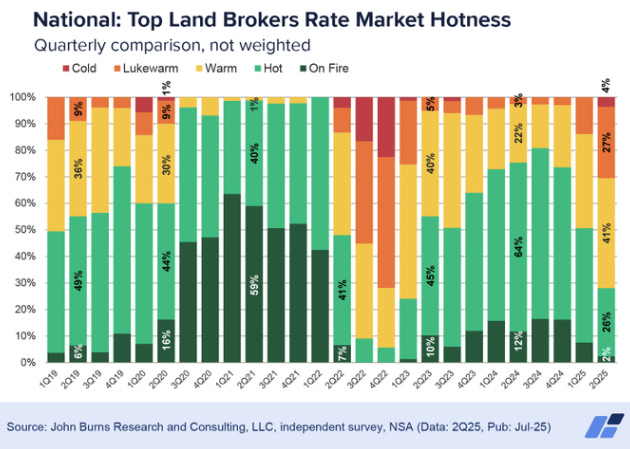

The builders have been capable of maintain out for awhile by slashing their margins (which have been traditionally excessive), however as I famous in my final letter, single household begins could also be about to sluggish even additional as massive constructing provide firm BLDR famous demand has fallen additional for them just lately. This will also be seen within the single household land market, which is starting to chill off per Burn Consulting.

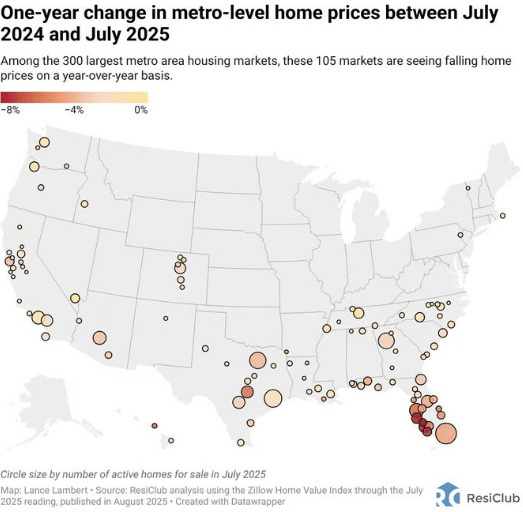

There are issues in housing past simply development – residence value declines are starting to unfold throughout the nation within the covid increase markets. Right here is an evaluation by ResiClub of Zillow (Z) residence knowledge by metro.

It’s price noting how regional the housing weak spot is presently – the northeast and midwest stay pretty wholesome. It’s simple to neglect however recessions have been way more regional traditionally, so maybe our subsequent downturn might be extra regional as properly.

The remainder of the financial system (ex tech), can also be exhibiting indicators of weak spot. Manufacturing is in contraction territory, and has been majorly negatively impacted by Trump’s tariffs. The ISM providers index is hovering at 50 (under 50 in contractionary). Hiring has fallen to just about zero (the newest official knowledge has been delayed as a result of authorities shutdown), with ADP reporting 2 adverse quarters for the primary time since 2020.

The most important contra to this weak spot for my part is solely the huge deficits we’re working at a whopping ~6% of GDP. This deficit spending boosts development, and could possibly offset the weak spot within the ‘actual’ financial system. We are able to see this within the jobs knowledge – an enormous share of all the roles being created during the last 6 months are in healthcare. However an financial system can not run on authorities spending eternally.

My concern is that the bubble bursting mixed with weak spot in the actual financial system would possibly make for a probably pretty tough recession. Within the dot com period the tech bubble burst however the US shopper & the remainder of the financial system (notably housing) was capable of energy by way of and preserve the downturn pretty gentle. After all there was arguably a value to be paid for this a number of years later… however regardless this doesn’t appear to be an possibility for at this time’s financial system.

Now what is perhaps the set off for the bubble to finish? Frankly I do not know – maybe will probably be Trump making an attempt to extend Chinese language tariffs to over 100%. However maybe will probably be one thing else. My greatest guess although is it occurs someday in 2026 because the AI capex spending slows down, taking gas out of the engine.

Curiosity Charges & Inflation

AI & manias are after all not the one factor taking place within the markets – rates of interest and inflation stay crucial & this nook of the market stays a little bit of a difficult state of affairs.

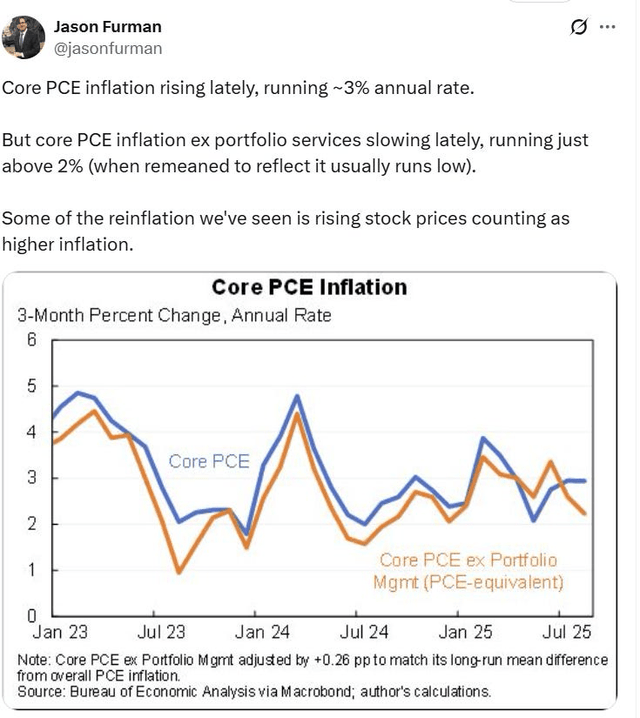

Core PCE has rebounded to the three% vary just lately, nonetheless a lot of that’s imputed from rising inventory costs. Right here is economist Jason Furman’s commentary.

Apparently providers inflation has slowed just lately, however has been offset by rising items inflation from tariffs.

Attributable to all of this plus I’m positive a wholesome concern of our large authorities spending, bond charges have stayed pretty excessive and the Fed has been cautious on cuts.

But when the financial system slows, and the tariff items inflation proves to be one time and doesn’t trigger a cascade, we may see inflation fall once more quickly which might clear the best way for additional Fed cuts in 2026. The Fed will not be unaware of the softening labor market, which helped spur their latest lower, and all of this mixed provides the markets some confidence in two extra projected cuts in 2025.

A bull market thesis is perhaps that the Fed can thread the needle right here and lower sufficient to stimulate sufficient demand to offset weakening development, whereas additionally not additional inflating the bubble we’re already in, and we nail the touchdown. I’m uncertain given the delayed results of financial coverage on the actual financial system, however it’s definitely potential! However even on this state of affairs I’d wager we see a 2022 type bubble cool off – traditionally the manic part of a cycle often lasts solely a 12 months or two.9

CRE

Now pricey reader, you is perhaps considering that was quite a lot of commentary on the financial system, and never a lot on CRE! And you’ll be right. However I simply printed my final CRE notes a month in the past, and never rather a lot has modified. So that you’ll have to attend till after Q3 REIT outcomes for extra CRE information – apologies to the CRE buffs who’ve to take a seat by way of all my financial ideas.

Fin

As at all times, thanks for studying. I’m completely comfortable to proceed to underperform the market because the mania continues, in order to raised protect capital in what’s I consider a probable downturn.

Thanks for studying Warden Capital!

|

Footnotes 1 The money burn fee is decrease for the time being as there’s a large inventory based mostly comp part right here apparently. 2 A lot ink might be spilled about an acceptable margin right here – it’s actually laborious to forecast. The hyperscalers are round 50% ex depreciation (bear in mind we don’t depend depreciation when returns on capex spending). Nevertheless given the large competitors within the AI area & the benefit of substitution it could not shock me if margins there are a lot a lot decrease, however lets give them the good thing about the doubt right here as an example the diploma of insanity we’re . 3 These figures are all extraordinarily tough, and I used spherical numbers for simple math however given the epic mismatch right here even when I’m off a bit the general image may be very clear. 4 Given films are merely a sequence of nonetheless pictures, after getting picture era down video era turns into as a lot an engineering problem as a frontier data one. 5 Most frontier researchers consider that your complete LLM structure is, at the very least by itself, a lifeless finish on the seek for AGI. And right here I don’t imply random workers at OAI, however extremely regarded frontier laptop scientists and researchers. My private view is that we could finally have the ability to create a sequence of programs working collectively, one among which is maybe an LLM, which may approximate intelligence. However we don’t even actually know what the total listing of elements there even are, not to mention the right way to construct them. I don’t imply to say the chances of some breakthrough taking place are nil – its definitely potential. However we’re actually far off. And that is painfully apparent if you attempt to use an LLM for something novel or complicated – they’re nice at search of present data, however very poor at creating something new (amongst different shortcomings). Which after all is not any shock in the event you perceive the structure behind LLMs. 6 A very tough means to think about the worth of what’s the most monetizable use case for LLMs, which is coding, is as follows. In case you assume AI makes coders 25% extra productive as a mean (research on this are fairly blended by the best way), and that now we have ~1.4 million software program builders within the US per BLS information, and the typical pay is let’s imagine $110k that’s roughly $154 billion in whole software program salaries within the US. 25% of that’s $38.5 billion. In case you assume the AI suppliers seize half of that, which may be very aggressive given how aggressive the area is, that’s possibly ~$19 billion in income obtainable for the US, max. Add in worldwide and let’s imagine its ~$50 billion. That’s for LLM’s largest use case, max. There are clearly different makes use of however coding is by far and away the place most revenues at this time are derived. And surplus seize is often far decrease than 50% in tech… take into consideration google. It’s actually free. So possibly greatest case LLMs generate $50 billion in coding associated revenues in 5-10 years, and possibly greatest case we’re at $100 billion most in finish person revenues by 2030, about 25% of what’s wanted simply to interrupt even on our present wave of GPU funding. However frankly it wouldn’t shock me whether it is alot decrease. 7 Peter Shor himself, the daddy of the eponymous algorithm for quantum factoring of integers & arguably the godfather of quantum computing, famous in a latest lecture that there are a number of theoretical issues quantum computer systems could also be higher at, however each time quantum researchers publish one thing alongside these traces a classical laptop scientist takes a have a look at the issue and is ready to devise a less expensive answer on classical computer systems. That is doubly damning – first clearly it undermines any notion of quantum supremacy for these issues, however secondly and maybe extra critically – the issues weren’t vital sufficient for anybody to spend any actual time on fixing them. Because the classical laptop scientists solely determined to check out these issues as soon as they noticed the quantum papers, as an instructional curiosity! 8 For instance some resort REIT’s revenues doubled from 2021 to 2022. 9 The large exception to this appears to have been Japan’s Nineteen Eighties bubble peak, which actually lasted a number of years. Would love to listen to of every other historic mania’s that lasted greater than a 12 months or two – bubbles and booms after all go for much longer however the really manic part, which I believe we’re clearly in now, is often a lot shorter. |

Editor’s Observe: The abstract bullets for this text have been chosen by Looking for Alpha editors.