hanibaram/iStock by way of Getty Photos

Abstract

- Fairness markets continued their robust momentum in Q3 2025, pushed by enthusiasm for generative AI and energy within the semiconductor sector. Traders largely appeared previous excessive tariffs, persistent inflation, and a softening labor market, as a substitute specializing in optimistic financial surprises, fiscal coverage optimism, and better-than-expected company earnings.

- Efficiency management as soon as once more concentrated in AI-driven sectors, notably semiconductors, with “risk-on” market sentiment favoring high-beta progress shares and leaving historically defensive sectors like healthcare, shopper staples, and actual property lagging. The market distinctly bifurcated corporations into “AI winners or losers,” contributing to exacerbated efficiency dispersion.

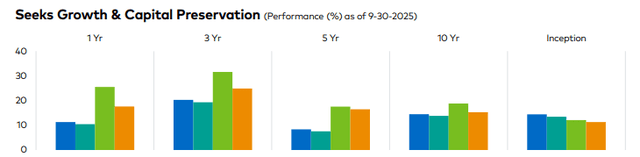

- In Q3 2025, the Polen Focus Progress Portfolio (“the Portfolio”) returned 3.3%, in comparison with 10.5% for the Russell 1000 Progress Index and eight.1% for the S&P 500.

- Prime relative contributors to efficiency included Oracle (ORCL) (boosted by document contract progress), Shopify (SHOP), and Meta (META) (not owned). The highest absolute contributors have been Oracle, Shopify, and Alphabet (GOOG)(GOOGL). The biggest relative detractors have been Apple (AAPL) (not owned), NVIDIA (NVDA) (underweight), and Tesla (TSLA) (not owned), whereas Accenture (ACN), ServiceNow (NOW), and Adobe (ADBE) have been the biggest absolute detractors.

- We initiated new positions in Broadcom (AVGO) and Boston Scientific (BSX), whereas exiting Gartner (IT) and Thermo Fisher Scientific (TMO). We additionally added to our holdings in Starbucks (SBUX), ServiceNow, and CoStar Group (CSGP), and trimmed positions in Netflix (NFLX), Alphabet, and Visa (V).

- Regardless of the short-term headwinds to our quality-driven strategy amid a concentrated “risk-on” surroundings, we preserve conviction that our emphasis on sturdy, high-quality companies positions the Portfolio for mid-teens or higher long-term earnings progress and resilience throughout market cycles.

|

Qtr |

YTD |

1Yr |

3 Yr |

5 Yr |

10 Yr |

Inception |

|

|

Polen Focus Progress (Gross) |

3.34 |

6.15 |

11.32 |

20.26 |

8.37 |

14.52 |

14.44 |

|

Polen Focus Progress (Internet) |

3.14 |

5.53 |

10.44 |

19.32 |

7.58 |

13.84 |

13.48 |

|

Russell 1000 Progress |

10.51 |

17.24 |

25.53 |

31.58 |

17.56 |

18.81 |

12.08 |

|

S&P 500 |

8.12 |

14.83 |

17.60 |

24.91 |

16.46 |

15.29 |

11.30 |

|

The efficiency information quoted represents previous efficiency and doesn’t assure future outcomes. ^The efficiency offered previous to April 1, 1992, just isn’t in compliance with the GIPS Requirements. Present efficiency could also be decrease or greater. Intervals over one-year are annualized. Efficiency figures are offered gross and internet of charges and have been calculated after the deduction of all transaction prices and commissions, and embrace the reinvestment of all revenue. Please reference the GIPS Report which accompanies this commentary. The commentary just isn’t supposed as a assure of worthwhile outcomes. Any forward-looking statements are based mostly on sure expectations and assumptions which can be prone to modifications in circumstances. Opinions and views expressed represent the judgment of Polen Capital as of the date herein, could contain plenty of assumptions and estimates which aren’t assured, and are topic to alter. Contribution to relative return is a measure of a securities contribution to the relative return of a portfolio versus its benchmark index. The calculation could be approximated by the under method, making an allowance for purchases and gross sales of the safety over the measurement interval. Please be aware this calculation doesn’t take note of transactional prices and dividends of the benchmark, because it does for the portfolio. Contribution to relative return of Inventory A = (Inventory A portfolio weight (%) – Inventory A benchmark weight (%)) x (Inventory A return (%) – Combination benchmark return (%)). All company-specific info has been sourced from firm financials as of the related interval mentioned. |

Commentary

In some ways, US fairness market efficiency for Q3 2025 noticed a continuation of the drivers that lifted shares from the ‘Liberation Day’ lows in early April and propelled them to shut out Q2 at document highs. Pleasure round generative AI (Gen AI) was once more the dominant theme and the place semiconductors have been the first driver of returns, serving to the Russell 1000 Progress Index to a ten.51% return for the quarter, reaching new document peaks seemingly each different week.

Even with the backdrop of the best tariff charges in virtually a century taking impact, stubbornly elevated inflation, a softening labor market, mixed with renewed query marks over the Federal Reserve’s independence and the fixed give attention to excessive valuations, traders have been in a position to simply shrug off these headlines and as a substitute centered on the shock enchancment in financial progress, potential fiscal tailwinds from the ‘One Large Stunning Invoice’ and the robust earnings reported throughout the quarter, with combination earnings ending properly above consensus expectations.

On the financial progress entrance, the US financial system shocked to the upside, rising at a revised annual charge of three.8% in Q2. Whereas the headline numbers have been reassuring for traders, it included a synthetic increase because of a pointy decline in imports, which was primarily an unwinding of the massive surge in Q1 as companies stockpiled stock forward of anticipated tariffs. Nevertheless, what was most notable within the information was the contribution from know-how capex, and AI-related spending particularly, outpacing the contribution from shopper spending regardless of its a lot smaller share of the overall financial system, reflecting the sheer magnitude of capital at present flowing into AI-related tasks.

The perfect illustration of this continued funding was Oracle’s quarterly earnings report, which confirmed remaining efficiency obligations (primarily contracted future cloud revenues) rising 359% to $455 billion in only one quarter, with the inventory rallying about 38% on the information. The sheer scale highlights extraordinary demand for cloud computing and AI infrastructure that exhibits no indicators of slowing down.

Thankfully, Oracle was one in every of Focus Progress’s largest holdings prior to those outcomes, offering an necessary increase to efficiency this quarter and year-to-date. Alongside our positions in Microsoft (MSFT), Alphabet, and Amazon (AMZN), this displays our conviction that almost all long-term worth from generative AI will accrue to cloud infrastructure suppliers and choose software program and providers corporations.

Whereas the headline financial progress numbers have been stable, additional beneath the floor there have been areas of concern, most notably the continued softening within the labor market and the place the burden of consumption is more and more being shouldered by greater revenue cohorts—reflective of the so known as ‘Ok-shaped’ financial system. Regardless of the ‘final mile’ inflation remaining stubbornly above the Federal Reserve’s goal of two%, their focus shifted extra to the employment facet of their twin mandate and lowered rates of interest by 25bps for the primary time this yr and guided for extra charge cuts throughout the rest of the yr and into 2026.

The opposite noteworthy commentary throughout the quarter was steerage from the hyperscaler administration groups round future capex intentions—not only for the rest of 2025 however for future years as properly. Traditionally, these corporations have tended to be conservative of their steerage round future spending, nonetheless we’ve not too long ago witnessed giant, introduced will increase to AI- associated spending, confirming the capex spigots are broad open because the hyperscalers battle to maintain up with the voracious demand.

With investor enthusiasm in the direction of something AI-related exhibiting no indicators of abating, the historically defensive sectors like healthcare, shopper staples and actual property lagged meaningfully on the quarter. The market has been fast to bifurcate sectors, industries and firms as ‘AI winners or losers’, and whereas there are particular headwinds that relate every of those areas and firms inside, it could seem many have been categorized into the latter till proving in any other case.

The persistent “risk-on” conduct of the market has meant ‘high-beta progress’ corporations have dominated the contribution to returns whereas ‘high quality’ and ‘low-volatility’ shares have lagged meaningfully.

Whereas our heavy emphasis on ‘high quality’ traits has been rewarded over the long-term, in narrowly pushed and ebullient markets just like the one we’re in right this moment, high quality can get left behind, exacerbated by an index that’s closely concentrated in handful of shares which can be driving nearly all of returns. Regardless of these continued headwinds to our philosophy and strategy, we retain conviction that our emphasis on high quality will likely be rewarded throughout the complete market cycle, similar to it has been for nearly 4 a long time now.

Portfolio Efficiency & Attribution

In Q3 2025, the Polen Focus Progress Portfolio returned 3.3% in comparison with 10.5% for the Russell 1000 Progress and eight.1% for the S&P 500. Prime relative contributors to the Portfolio’s efficiency included Oracle, Shopify, and Meta (not owned). The highest absolute contributors have been Oracle, Shopify, and Alphabet.

The biggest relative detractors within the quarter have been Apple (not owned), NVIDIA (underweight), and Telsa (not owned). The biggest absolute detractors have been Accenture, ServiceNow, and Adobe.

Following on from Q2’s +56% rally, Oracle was once more our top-owned relative contributor put up their spectacular quarterly outcomes exhibiting an enormous acceleration in demand for his or her cloud infrastructure providers, with the fill up ~29% in Q3. When reacquiring Oracle in September final yr, our funding thesis was predicated on an anticipated acceleration in progress throughout their software, database and cloud infrastructure companies (and the expectation that cloud infrastructure can be rising the quickest) – very clearly that thesis is taking part in out, with Oracle within the midst of a considerable acceleration in revenues.

The notable drag on relative returns this quarter stemmed from our zero or underweight positions in three ‘Magnificent 7’ corporations that make up outsized weightings within the benchmark – particularly Apple, Tesla and NVIDIA – who collectively comprise ~27% of complete index publicity and signify virtually half of this quarter’s underperformance.

On the trade stage, lots of our software program holdings additionally dragged, because the traders grapple with Gen AI developments and the potential adverse impression it might have on the trade. Whereas we imagine that Gen AI will little question create disruption throughout the house, we’ve robust conviction within the names we personal, that they’ve differentiated choices, are embracing Gen AI and embedding it inside their services and products, positioning them properly to learn from the know-how over the long run. Mixed with their excessive recurring revenues, excessive margins, excessive switching boundaries and broad aggressive moats, in addition they proceed to offer a high-quality and chronic earnings streams that assist to ship the mid-teens combination portfolio earnings progress that’s our major aim.

Lastly, our broad publicity to well being care was additionally a headwind – in comparison with the Index (which suffers from excessive focus on the inventory and sector ranges, with heavy publicity to the higher- beta areas of the market and little or no publicity to extra defensive areas) – we’ve a a lot greater weighting to the sector (18% vs. 7%) given the decrease/non-cyclical revenues and earnings that may present ballast, and that we imagine are essential components to constructing a sturdy portfolio that may navigate via all method of market environments. Consequently, we personal a quantity differentiated well being care companies (e.g. Zoetis (ZTS), IDEXX Laboratories (IDXX), Boston Scientific, Abbott Laboratories, Eli Lilly (LLY)) that we really feel supply a sexy mixture of above common earnings progress, non-cyclicality or decrease cyclicality together with sturdiness and persistence of their revenues and earnings.

Whereas the risk-on sentiment that has propelled markets these previous 6-months has left traders ignoring the traditionally steady sectors like well being care, and the place the coverage backdrop and funding headwinds have weighed on the sector and exacerbated any idiosyncratic points, we preserve perception within the high-quality names that we personal and the necessary position they play within the portfolio – which was notably on show throughout the carnage of Q1 this yr.

Portfolio Exercise

In Q3 2025, we initiated new positions in NVIDIA, Broadcom, Boston Scientific, Intuit (INTU), Synopys and Uber (UBER) and eradicated our positions in Gartner and Thermo Fisher Scientific. We additionally added to our positions in Starbucks, ServiceNow, CoStar Group, and Adobe and trimmed our place in Netflix, Alphabet, Visa, Workday (WDAY), Amazon, Adobe, Airbnb (ABNB), Abbott Laboratories (ABT), Shopify, and Oracle.

In early August we initiated positions in each NVIDIA and Broadcom, after having not owned both firm over the previous 2½ years following the preliminary wave of enthusiasm round Gen AI. Whereas we’ve lengthy admired each corporations, their extremely cyclical enterprise fashions have made it extraordinarily troublesome to forecast future earnings progress with any diploma of conviction. Given our strategy of in search of sturdy and chronic earnings progress that compounds over lengthy holding intervals, our concern in holding both was that we might be pressured to endure a punishing downcycle inside our typical holding interval – there’s little or no room that in a concentrated portfolio of 20-30 corporations. Actually, pre-ChatGPT, NVIDIA had two punishing down cycles over the previous 5 years.

Nevertheless, our group is consistently reevaluating every firm that meets our high quality guardrails, in search of to be intellectually trustworthy and being keen to evolve our opinions when the details change or when extra info is offered.

That’s particularly what has occurred for NVIDIA and Broadcom. Whereas the sheer magnitude of demand for AI chips, servers and networking gear was one thing that we clearly underappreciated, new incremental information factors over the previous few months lead us to conclude the present growth in AI chips and associated {hardware} will possible proceed for the foreseeable future giving us better conviction over the trajectory of future earnings for each NVIDIA and Broadcom.

These new information factors included: Oracle’s $30 billion annual income cloud contract (6/30), U.S. tax incentives reinstating 100% bonus depreciation for short-lived belongings, boosting information heart funding (7/4), Meta’s pledge to speculate “lots of of billions” in multi-gigawatt information heart clusters (7/14), and Google’s capex hike to $85B for 2025, with extra deliberate for 2026 (7/23). These information factors mixed with our present basic analysis led us to imagine that the expansion potential for corporations stays robust whilst progress moderates from the extremes of the previous few years—Oracle’s current earnings outcomes (highlighted earlier) reinforce that perception and our choice to commerce each names into the portfolio earlier within the quarter.

NVIDIA produces the quickest chips which can be in a position to course of compute intensive duties like Gen AI coaching fashions extraordinarily effectively, are very versatile so can be utilized for any sort of workload, and because of this are the chips in highest demand because the hyperscalers construct out their Gen AI infrastructure (NVIDIA at present receiving 90c of each greenback spent on AI accelerated semiconductors). Their enterprise has a really robust aggressive moat, which is partly in regards to the velocity of their chips, but in addition all the ecosystem they’ve constructed round them (programing language, coaching fashions and related community results).

Broadcom is the opposite main participant within the AI chip market, the primary supplier of customized chips, and at present receives nearly all of the remaining 10c of each greenback being spent by enterprises. As Gen AI use circumstances mature, and as inference workloads change into a much bigger piece of the compute pie, we count on that customized chips (and Broadcom’s particularly) will account for a bigger share of the overall market.

We anticipate that each corporations will be capable to generate earnings progress at ~20% each year over the following 3-5 years and that their P/E multiples in mid-to-high thirties have been truthful valuations for the extent of anticipated future earnings progress. We nonetheless imagine that these corporations are cyclical, however we don’t count on the downcycle within the subsequent few years. If something, the spend intent from their largest clients appears set to proceed unabated and there’s threat to any firm that stops investing whereas their rivals push ahead in a Gen AI world.

As well as, we initiated a brand new place in Intuit, a options enterprise which homes Quickbooks accounting software program, payroll and funds providers largely for small companies. The corporate has a dominant share of the small enterprise accounting and do-it-yourself tax software program market. Even so, we imagine there stays a superb runway for progress as many small companies nonetheless don’t use accounting software program, and Intuit has been adept at introducing new options and providers to make its merchandise simpler and extra “intuit”ive to make use of. Gen AI brokers match neatly into the corporate’s choices to assist information small companies handle their funds and enterprise software program simply, which frees up time for them to run their companies, and in addition see the introduction of AI brokers into their Quickbooks choices enhancing promoting costs.

We count on Intuit to develop income at a mid-teens charge and earnings at a high-teens charge going ahead.

We additionally acquired a 2% place in Boston Scientific, a worldwide chief in medical merchandise that deal with numerous cardiovascular and different circumstances. During the last two years they’ve witnessed a significant acceleration of their progress profile based mostly on two major catalysts: their Farapulse platform for pulse subject ablation (PFA) and their Watchman platform for atrial appendage. PFA is a more moderen medical process used to deal with atrial fibrillation that’s much less invasive, extra exact and sooner than extra conventional ablation procedures and with fewer dangers than treatment. PFA is more likely to change into the usual of care on this remedy paradigm and Farapulse is poised to be the market Chief. The Watchman phase which already dominates market share, is a everlasting implant designed to cut back the chance of stroke in sufferers with atrial fibrillation, represents a significant and accelerating share of their revenues. With an general income progress charge within the low double-digit vary mixed with modest margin enlargement, we count on Boston Scientific to develop their earnings within the mid-teens over the following 3-5 years.

We opportunistically initiated a brand new place in Synopsys (SNPS) as properly, who’re a market chief in digital design automation (EDA), notably utilized by semiconductor corporations to design chips. They’d an uncharacteristic miss on reported revenues throughout the quarter, stemming from what we imagine to be momentary points, that resulted in a ~35% decline of their share worth. We opportunistically used that steep lower so as to add what we imagine is a good enterprise to the portfolio, that may be a direct beneficiary from the secular tailwinds of ‘the democratization of chips’ and Gen AI pushed capex and who we anticipate will ship mid-to- excessive teenagers earnings progress over the long-term.

Moreover, we acquired a brand new place in Uber throughout the quarter. We now have adopted Uber for a few years and imagine their scale, community results, progress alternatives and market place, mixed with their present valuation make a compelling funding thesis. They’ve change into one of the vital recognizable shopper manufacturers on the earth and anticipate practically $200bn in reserving transactions for 2025. Over the previous three years, they’ve compounded revenues at 36%, EBITDA at 69% and FCF margins have gone from adverse to mid-teens. Whereas the specter of autonomous automobiles looms and is probably going weighing on the valuation, we imagine that risk is a few years away and so view that threat as low, and we count on Uber to compound earnings at ~20% p.a. over the following 5 years. Actually, we predict the quickest manner for autonomous car corporations to scale is to companion with a big and extremely utilized platform like Uber who has dominant market place the place it competes.

We exited our small place in Gartner after greater than 12 years, throughout which earnings and share worth every grew about 7.5x, delivering a 17.5% annualized return—precisely what we hoped for. This efficiency was pushed by the subscription-based analysis enterprise, which traditionally delivered constant double-digit income progress at excessive margins. Whereas administration nonetheless targets 10% income progress, precise progress has slowed to mid-to-high single digits because of incremental headwinds. With restricted margin enlargement forward, we’ve much less confidence in Gartner’s means to generate enough EPS progress for enticing returns.

Lastly, we additionally eradicated our remaining place in Thermo Fisher Scientific to assist fund the acquisition of Uber. Thermo Fisher Scientific is at present navigating a mix of macro, coverage and funding headwinds that whereas cyclical, are more likely to persist for the foreseeable future and subsequently we felt the portfolio can be higher served by a reallocation of proceeds to what we imagine to be a superior portfolio candidate.

Outlook

Over the course of our 36-year historical past, we’ve by no means sought to be on the vanguard of nascent, rising developments in markets, as a substitute, ready for proof of sturdiness and persistence in revenues and earnings earlier than embarking on our supposed long-term journey— and this strategy has typically served us properly for over three a long time. We acknowledge that the timing of our current acquisitions of NVIDIA and Broadcom are after the costs for each have appreciated materially, nonetheless it’s our perception that we’re nonetheless within the early innings of this Gen AI infrastructure buildout and so count on these new additions will ship necessary contributions to the earnings progress and complete return of the portfolio. Mixed with the opposite extremely competitively advantaged companies we personal, we anticipate mid-teens or higher earnings progress over the long run and count on that the portfolio’s returns will converge with the underlying earnings profile in time.

Whereas the Magnificent 7 corporations—a homogeneous grouping we imagine oversimplifies the variations amongst these companies— continues to seize the headlines and drive market efficiency, we’ve additionally seen rising divergence among the many constituents to date this yr which could counsel that their heterogeneity is changing into extra outstanding. Mixed with the superior efficiency of companies outdoors of this group (e.g. Oracle, Broadcom) it might be that we’re lastly seeing a broadening of market efficiency away from this grouping, which we imagine bodes properly for our portfolio of nice progress companies that span the spectrum of sturdy progress alternatives throughout sectors and industries.

Thanks to your curiosity in Polen Capital and the Focus Progress technique. Please be happy to contact us with any questions or feedback.

Sincerely,

Dan Davidowitz and Damon Ficklin

Authentic Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.