This text was produced for ProPublica’s Native Reporting Community in partnership with the North Dakota Monitor. Join Dispatches to get our tales in your inbox each week.

Reporting Highlights

- In search of Assist: North Dakota mineral house owners requested state leaders to assist them get data from oil corporations.

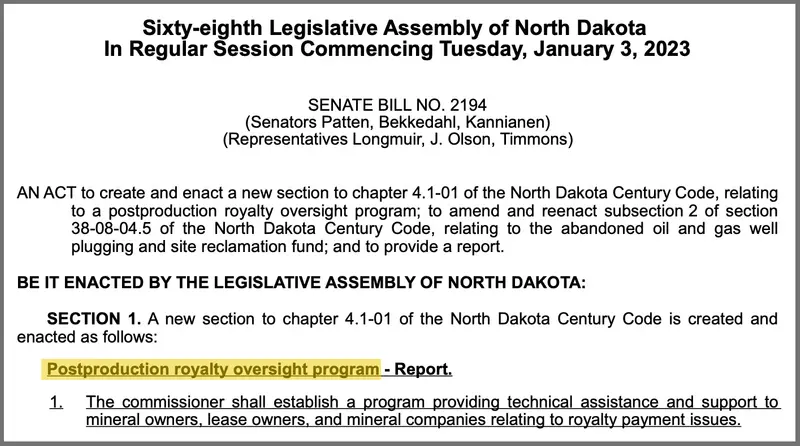

- Oversight Program: Lawmakers created a royalty oversight program. It had assist from the trade however was lower than mineral house owners needed.

- Restricted Scope: This system has solved some considerations, however it has failed to handle a significant one.

These highlights have been written by the reporters and editors who labored on this story.

One morning in February 2023, a small group of mineral house owners arrived on the North Dakota Capitol on a mission. They’d traveled from throughout the state and different elements of the nation to elucidate to lawmakers how the highly effective oil and gasoline corporations had been chipping away at their revenue.

It’s not simple to recruit individuals to testify through the winter months of the legislative session. Ranchers are busy with the calving season. Snowbirds have relocated to hotter climates. It’s a greater than three-hour drive for these residing within the Bakken oil area.

However those that made it to Bismarck lined up at a podium to share particulars of their very own experiences and the broader considerations affecting the estimated 300,000 individuals who obtain cash from the trade in trade for the best to their underground minerals. For almost a decade, they’d grappled with corporations withholding important parts of their royalty funds with out explaining how they decided how a lot to deduct, because the North Dakota Monitor and ProPublica reported final week.

Now they have been on the Capitol for a selected purpose: They needed legislators to require corporations to supply extra data so house owners might discern in the event that they have been being paid appropriately, and to impose penalties if corporations did not comply.

Shane Leverenz, who manages revenue his prolonged household receives from quite a few oil wells, learn aloud electronic mail responses from corporations for instance the shortage of cooperation mineral house owners face once they request data. “We aren’t obligated to mail every proprietor a calculation as to how their curiosity was calculated,” one firm wrote.

“There isn’t any transparency,” Leverenz informed the legislators. Leverenz, whose great-grandfather homesteaded in North Dakota and had his property deed signed by President Theodore Roosevelt, has helped manage royalty house owners on this challenge lately. Leverenz grew up in Epping, a city of fewer than 100 individuals within the northwest a part of the state, and traveled to North Dakota from Texas, the place he now lives, to testify.

Credit score:

Jeremy Turley/Discussion board Information Service

After enter from Leverenz and others, lawmakers determined to create a brand new state program that they hoped would deal with conflicts between royalty house owners and firms. Specifically, mineral house owners had mounting considerations over postproduction deductions, the cash corporations withhold to cowl the prices of processing and transporting minerals after they’re extracted and earlier than they’re offered. Corporations say they’re allowed to move on a share of these prices, whereas royalty house owners say they shouldn’t bear that accountability as a result of most often lease agreements don’t point out these bills.

The state’s “postproduction royalty oversight program” had the assist of the trade, however it was far lower than what Leverenz and different house owners needed. Within the two years since its creation, this system has not lived as much as its title and has not alleviated house owners’ considerations over deductions or transparency, an investigation by the North Dakota Monitor and ProPublica discovered. This system has resolved 69 circumstances to date, and none have concerned postproduction deductions, in response to paperwork obtained beneath a public data request. A case can characterize a criticism or query from a royalty proprietor.

“The legislative intent was imagined to be addressing the difficulty of the postproduction prices that they have been hitting individuals with,” mentioned Rep. Don Longmuir, a Republican from Stanley, within the northwest nook of the state.

The newsrooms’ investigation discovered that this system has centered on different points. It has as an alternative helped house owners resolve complaints about corporations withholding funds completely and failing to pay curiosity on late royalty funds, data present. Some mineral house owners mentioned in interviews that they don’t belief state officers to assist them get details about the deductions and subsequently haven’t tried to make use of this system.

Leverenz mentioned this system, additionally known as the ombudsman program, has not completed what he and different royalty house owners have been informed it might. He has taken six complaints to the ombudsman; three have been resolved however three stay open, together with two for greater than a yr. The unresolved complaints don’t contain deductions, he mentioned, and give attention to different points together with his household’s royalty funds.

“The ombudsman is operating into the identical factor that I’ve, the place there’s simply no response from the oil corporations or they stalled,” Leverenz mentioned. “There’s been no ahead momentum.”

Ron Webb, who coordinates this system throughout the state’s Division of Agriculture, mentioned it has helped facilitate communication between mineral house owners and firms. He mentioned this system is voluntary and doesn’t have authority to compel corporations to vary how they calculate funds and even to supply data. “Oil corporations usually are not required to work with us,” Webb mentioned.

This system not promotes itself as having the ability to oversee considerations about royalty deductions regardless that that was a part of the legislative intent. On the division’s web site and in a brochure, the phrase “postproduction” has been dropped from this system’s title regardless that it’s within the title of the legislation that created it.

The division’s authorized counsel, Dutch Bialke, mentioned the title of the legislation is irrelevant to how this system operates.

“The title is completely legally non-binding and has no authorized impact,” he wrote in an electronic mail, citing North Dakota legislation.

Credit score:

Obtained by North Dakota Monitor and ProPublica. Highlighted by ProPublica.

“Nothing Is Clear”

Ever since Neil Christensen and his sisters seen in 2016 that Hess Corp. was withholding almost 25% of their royalty revenue — up from lower than 1% simply two years earlier — his household has tried to get solutions from the corporate.

He traveled to Minot, North Dakota, some years in the past to satisfy with Hess representatives at their manufacturing workplaces. He additionally referred to as the corporate’s accounting workplace and its royalty proprietor hotline, however he mentioned their explanations didn’t make sense.

“It doesn’t appear as if the corporate has a big curiosity in explaining themselves,” Christensen mentioned. Spreadsheets stored by his household present withholdings have been as a lot as 42% lately. “The transparency challenge is an enormous drawback with oil operators and mineral house owners.”

The royalty statements will be a whole bunch of pages lengthy however present solely a common description of the explanations for the deductions, leaving house owners unable to confirm the businesses’ prices and whether or not they’re being paid a fair proportion. Christensen’s household and others mentioned they’ve had funds lowered for bills the businesses incurred years earlier.

“Nothing is obvious,” mentioned his sister Naomi Staruch, who has spent most of her profession working in finance for banks and church buildings in Minnesota. “I’d get so annoyed actually wanting onerous on the statements.”

Diana and Bob Skarphol, who’ve advocated for years on behalf of royalty house owners, mentioned complicated and overwhelming royalty statements are a typical concern. The couple obtained one assertion final yr that included 39 pages of calculations for a single properly — together with reductions to previous royalties going again 9 years. The Skarphols obtained $1.15 that month from the manufacturing of the properly.

Merrill Piepkorn, a Democratic former state senator from Fargo who was the prime sponsor of the transparency laws, mentioned oil corporations’ ways are “obfuscation by means of transparency.”

“You get a lot data, there’s no approach to discover what you’re searching for,” mentioned Piepkorn, who unsuccessfully ran for governor in 2024.

Todd Slawson, chair of the North Dakota Petroleum Council, mentioned royalty statements are complicated partially as a result of state regulators throughout the final decade started requiring corporations to incorporate extra classes of knowledge. Hess mentioned it maintains an internet portal the place royalty house owners can entry their royalty data and operates a name middle that mineral house owners can contact with questions.

North Dakota doesn’t regulate the prices that corporations can move on to particular person house owners, although the state and federal governments regulate deductions on government-owned land. The state audits the royalties paid on state-owned minerals to make sure the quantities are right and, since 1979, the state’s leases don’t enable deductions. However non-public mineral house owners don’t have that very same entry and infrequently study deductions by evaluating their statements with each other.

“It’s type of all rigged towards the person royalty proprietor,” Leverenz mentioned.

State officers have informed mineral house owners that they will’t become involved in non-public disputes and that litigation is the house owners’ finest recourse. However litigation isn’t financially possible for many households, in response to lawyer Josh Swanson, who represents mineral house owners.

“It simply exceeds six figures, and that’s cost-prohibitive for most people,” Swanson mentioned. “A part of the playbook for lots of operators is making this stuff as cost-prohibitive as they will.”

Swanson was the lawyer Janice Arnson and her household employed to attempt to get solutions from Hess. Hess had been deducting between 15% and 36% of their royalty revenue every month since 2015, in response to a spreadsheet maintained by Arnson. They’d no luck getting a proof from the corporate till they employed Swanson in 2017. When Hess responded, an organization lawyer mentioned in a letter that the deductions have been “correct and permissible” beneath the phrases of the lease. Whereas Swanson disagreed, the household declined to pursue litigation as a result of “it was going to be an costly go well with.”

“We have been one small, little household,” mentioned Arnson. “We simply didn’t have the sources towards Hess to struggle.”

(Hess didn’t contest or touch upon Arnson’s or Christensen’s claims.)

Some royalty house owners have turned to the Northwest Landowners Affiliation, a nonprofit advocacy group, for assist. Troy Coons, the group’s chair, mentioned he has fielded a number of calls every week from royalty house owners who’re offended that state leaders haven’t helped them with the deductions. “It’s a large concern for individuals,” mentioned Coons, whose group has sued the state on behalf of property house owners on a special challenge. “We’re not imagined to be bearing the burden of bills.”

Lawmakers initially had bipartisan assist in 2023 for a invoice that will have assured mineral house owners entry to digital spreadsheets detailing their funds and would have required corporations to supply extra data on how they calculate a royalty proprietor’s share of the revenue from every properly. It additionally would have directed courts to require corporations to reimburse royalty house owners for attorneys’ charges in the event that they efficiently sued for the data.

However that invoice was discarded in favor of laws creating the royalty oversight program.

The Legislature “took our invoice they usually stripped it of every thing, they usually shoved the ombudsman program into it,” Leverenz mentioned. They created this system “with the guarantees that, you realize, that is going to be the reply to all the problems which have been introduced up over time with the royalty house owners.”

Sen. Brad Bekkedahl, a Republican from Williston, initially backed each payments. The senator mentioned he hoped the invoice creating the ombudsman program can be amended within the legislative course of to provide it extra authority to advocate on behalf of mineral house owners. That didn’t occur.

“That may have been, I feel, extra useful to royalty house owners,” mentioned Bekkedahl, who finally voted towards it.

“Barking Up a Tree”

In pitching this system to lawmakers in 2023, Doug Goehring, the state’s agriculture commissioner, mentioned the aim was to “attempt to develop some decision” for royalty house owners with questions on their funds, together with considerations over deductions.

The invoice required a report back to legislators. Goehring informed lawmakers he would share with them “full and full data regarding the circumstances” dealt with by this system and the problems confronted by mineral house owners with a view to inform future laws. “We’ll definitely present you situations, conditions, and a few of the challenges and difficulties we’ve handled,” Goehring, a Republican, testified in 2023. “And even some solutions about the way you right a few of this shifting ahead.”

The end result has fallen wanting what Goehring pledged in testimony, the information organizations discovered. Goehring now says it’s not this system’s job to search out decision for royalty house owners who query the deductions. “We don’t have a leg to face on to attempt to advocate or attempt to extort cash out of the corporate,” Goehring mentioned. He mentioned an exception is that if deductions are particularly prohibited in leases, however most agreements, particularly these signed many years in the past, are silent on the difficulty of deductions.

As an alternative of an in depth report, Goehring delivered a one-page abstract to legislators in September that broadly categorized the problems dealt with by means of this system. Legislators accepted the report with out dialogue. Goehring mentioned a extra detailed report was not essential. “They don’t wish to know that,” he mentioned. “We typically don’t write studies in that method. We give them the fundamental data.”

Credit score:

Kyle Martin for the North Dakota Monitor

Of the 147 circumstances filed with this system, about half stay unresolved, together with greater than two dozen which have been pending since 2023. Goehring mentioned a few of the circumstances stay open on the request of royalty house owners.

Two of the pending circumstances contain postproduction deductions, together with one which has been open since September 2023, in response to Bialke, the Agriculture Division’s authorized counsel.

The circumstances are assigned to 2 power corporations that function ombudsmen, Diamond Assets and Aurora Power Options, which contact the businesses on behalf of the mineral house owners. Neither of the businesses responded to questions from the North Dakota Monitor and ProPublica.

The information organizations paid $425 to acquire data associated to the circumstances that had been resolved as of late June. In these circumstances, the ombudsmen have answered royalty house owners’ questions and obtained solutions for them when corporations had not been responsive. In some circumstances, they mediated options that resulted in royalty house owners receiving funds they have been owed, data present.

In a single case, an ombudsman spent almost 10 months going forwards and backwards with an organization till the royalty proprietor bought paid. In different circumstances, ombudsmen helped royalty house owners perceive technical points associated to taxes and the probate course of after inheriting minerals. The division redacted firm names from the paperwork launched, with Bialke citing state legislation.

“It has been extraordinarily useful for annoyed royalty house owners who can’t get their questions answered,” mentioned Slawson of the North Dakota Petroleum Council, who additionally owns an power firm. “Having deductions immediately present up on income checks and questions not being answered or not defined properly can result in suspicions of wrongdoing.”

Kenneth Schmidt, who owns minerals close to Ray in Williams County, contacted this system after struggling to persuade an organization that it owed curiosity on late royalty funds as mandated by state legislation. It took just a few months, he mentioned, however the firm paid him.

“I used to be very glad with this system,” mentioned Schmidt. “As an alternative of going to an lawyer and I’ll pay $400 an hour, they did it at no cost, however by means of the state.”

Goehring mentioned this system has been profitable, citing suggestions from the trade in addition to the truth that no payments associated to royalty deductions have been launched throughout this yr’s legislative session, the primary time in almost a decade.

“If there’s no payments which might be developing, then is not that a sign? It’s type of like when you don’t have a cough, then perhaps you don’t have a chilly,” he mentioned.

Whereas this system has resolved disputes like Schmidt’s, that are extra cut-and-dried, it isn’t properly geared up to deal with extra complicated disagreements, Goehring mentioned. That isn’t a shock to one of many lawmakers who labored on the invoice.

“I don’t doubt that in some circumstances, facilitating that communication in all probability helped, however I don’t suppose it provides all of the solutions to the royalty house owners that they’re searching for,” Bekkedahl mentioned.

Various royalty house owners informed the information organizations they merely don’t belief this system to assist. “I didn’t really feel the ombudsman program had any tooth in it in any respect to do something,” mentioned Brian Anderson, who has not filed a criticism regardless that he needs corporations to extra totally clarify their deductions. “They’ll placate you; they’re not going to do something about it.”

Curtis Trulson, a royalty proprietor in Mountrail County, agreed: Going to this system, he mentioned, is simply “barking up a tree.”