Reporting Highlights

- Struggling Gatekeepers: Within the face of some $44 billion a yr in pig-butchering scams carried out by Asian crime syndicates, U.S. banks have failed to stop mass scale cash laundering.

- Black Market Financial institution Accounts: Chinese language-language Telegram channels supply to lease U.S. financial institution accounts to pig-butchering scammers, who use the accounts to maneuver victims’ money into crypto.

- One Deal with, 176 Purchasers: Financial institution of America allowed a whole lot of unverified prospects to open accounts, prosecutors alleged, together with 176 who claimed the identical small residence as their handle.

These highlights have been written by the reporters and editors who labored on this story.

Brian Maloney Jr. was flummoxed when he was served with a lawsuit in opposition to his household’s enterprise, Middlesex Truck and Coach, in January. Maloney and his father, additionally named Brian, run the operation, positioned in Boston, which boasts that it may possibly restore something “from two axles to 10.” A burly man in his mid-50s who wears short-sleeved polo shirts emblazoned with the corporate identify, Maloney Jr. has been round his dad’s store since he was 8. The storage briefly surfaced within the media in 2012 when then-presidential candidate Mitt Romney made a marketing campaign cease there and the Boston Herald featured Maloney Sr. speaking about how he had constructed the enterprise from nothing in a neighborhood he described as having been a “struggle zone.”

Now Middlesex was being sued by a New Jersey man who claimed he had been defrauded of $133,565 in a cryptocurrency scheme. The go well with claimed Middlesex “managed and maintained” a checking account at Chase that had been used to gather the fraudulent cost. The purported sufferer wished his a reimbursement.

None of this made any sense to Maloney Jr. His firm didn’t have an account at Chase, and he barely knew what crypto was. “For God’s sake, we repair vehicles and nonetheless have AOL,” he would later say.

It was solely after Maloney went to Chase to research that he was capable of piece collectively a minimum of a part of the reason. It turned out that Chase had allowed an unknown particular person, who utilized on-line with no identification, to open an account underneath Middlesex’s identify, in line with data Chase offered to Maloney. The account was then used to solicit a whole lot of hundreds of {dollars} from fraud victims, together with the $133,565 from the person who was now making an attempt to reclaim his funds.

Middlesex’s expertise, as weird because it appears, is a part of a world drawback that plagues the banking business. The account falsely opened in Middlesex’s identify, and plenty of others prefer it, are manner stations in a complicated multistep cash laundering course of that transports money from U.S. rip-off victims to crime syndicate bosses in Asia.

There’s been an explosion in worldwide on-line fraud in recent times. Notably widespread are “pig-butchering” schemes, as ProPublica reported in 2022. The macabre identify derives from the method of methodically “fattening” victims by getting them to contribute increasingly more cash to an funding scheme that appears to be succeeding, earlier than ultimately “butchering” them by taking all their deposits. Typically operated by Chinese language gangs out of prison-like compounds in Cambodia, Laos and Myanmar, pig-butchering in that area has reached a staggering $44 billion per yr, in line with a report by america Institute of Peace, and it probably includes tens of millions of victims worldwide. The report known as the Southeast Asian rip-off syndicates the “strongest legal community of the trendy period.”

An enormous portion of such fraud is transacted in cryptocurrency. However provided that the standard client doesn’t personal crypto, many scams unfold with a sufferer tapping a conventional checking account to wire {dollars} to swindlers, who obtain the funds in their very own accounts, then convert them into crypto to maneuver throughout borders. Later within the course of, the scammers will usually switch their crypto again into commonplace foreign money.

Financial institution accounts are so essential to this course of {that a} thriving worldwide black market has developed to lease accounts for fraud. That, it appears, is how a Chase account within the identify of Middlesex ended up as a repository for the proceeds of pig-butchering.

The massive demand for accounts used for misbehavior provides banks a vital, and never at all times welcome, function as gatekeepers — a accountability required by U.S. legislation — to stop criminals from opening accounts or partaking in cash laundering. But from the U.S. to Singapore, Australia and Hong Kong, banks have persistently failed at that accountability, in line with specialists who’ve investigated cash laundering, in addition to evaluations of fraudulent account particulars shared by victims and court docket circumstances reviewed by ProPublica. The listing of economic establishments whose accounts pig-butchering scammers have made use of contains world behemoths like Financial institution of America, Chase, Citibank, HSBC and Wells Fargo and plenty of different U.S. and overseas lenders.

The banks stated in statements to ProPublica that they make in depth efforts to combat fraud by investing in techniques to detect suspicious exercise and to report it to authorities (learn the banks’ statements right here). The American Bankers Affiliation, which represents the business, acknowledged that “with greater than 140 million financial institution accounts opened yearly unhealthy actors can generally get via regardless of decided and ongoing efforts to cease them.” However the group stated different industries like telecommunications suppliers and social media platforms have to do extra to combat fraud as a result of there’s solely a lot that monetary establishments can do.

Pig-butchering scams current some distinctive challenges for banks. Amongst different issues, a buyer in thrall to a fraudster will generally foil their very own financial institution’s makes an attempt to stop them from sending cash to a legal. And foreign-based scammers have turn out to be adept at discovering middlemen within the U.S. to use the banking system. “Cyber-enabled fraud operations in Southeast Asia have taken on industrial proportions,” in line with an October report by the United Nations Workplace on Medication and Crime. John Wojcik, one of many authors of the report, advised ProPublica, “Banks have by no means been focused at this scale, in these methods.”

It doesn’t assist that there are “no actual requirements as to what a financial institution has to do for detecting fraud or cash laundering,” stated Lester Joseph, a monetary compliance marketing consultant who used to supervise cash laundering circumstances on the Division of Justice and later labored at Wells Fargo. The principle legislation governing U.S. compliance regimes, the Financial institution Secrecy Act, requires monetary establishments to take care of packages to know their prospects and to detect and report suspicious exercise to the federal government. That may imply noticing, say, {that a} newly opened account is instantly receiving and sending a whole lot of hundreds of {dollars} of wire funds every month.

However it’s as much as banks to design these packages. The laws don’t even require that the packages be efficient. That offers banks broad flexibility on how a lot due diligence and monitoring to do — or not do. Extra scrutiny upfront means slowing down enterprise and including prices. Many banks don’t ask questions till it’s too late.

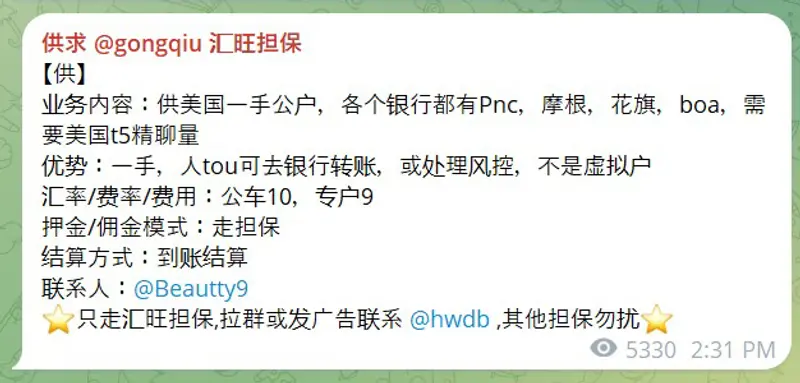

When you’re a legal trying to acquire a checking account with no pesky formalities, it’ll take you solely minutes to seek out one on the messaging app Telegram. Chinese language boards there characteristic adverts for “automobiles” or “fleets” — financial institution accounts or different on-line cost platforms that can be utilized to gather stolen funds. (The automobile metaphor stems from the truth that in Chinese language slang, cash laundering operations are often known as “motorcades.”) One Telegram advert supplied accounts at PNC, Chase, Citi and Financial institution of America and boasted of “firsthand” management of the accounts: “Individuals can go to the financial institution to switch cash,” the advert stated.

Credit score:

Screenshot by Cezary Podkul

One other Telegram channel listed numerous flavors of pig-butchering scams for which it offered financial institution accounts. The group, named KG Pay, boasted of accepting wire transfers, making withdrawals from U.S. banks and changing deposits into crypto to switch them to scammers. KG supplied to deal with deposits of as much as $1 million in accounts that imitate “regular enterprise transactions.” To keep away from suspicion, KG stated, it sliced huge quantities into smaller batches. If banks grew suspicious and froze certainly one of its accounts, KG stated, it had brokers able to name customer support to influence them to raise the freeze. For smaller transfers, a video tutorial contained in the channel confirmed how straightforward it was to ship money utilizing the Chase app. (Telegram deleted the KG Pay channel after ProPublica requested about it. In an announcement, Telegram stated it “expressly forbids cash laundering, scams and fraud and such content material is instantly eliminated every time found. Each month, over 10 million accounts, teams and channels are eliminated for breaching Telegram’s phrases of service — together with guidelines that prohibit cash laundering and fraud.”)

Demand for cash laundering is large in Sihanoukville, a seedy playing hub in Cambodia infamous for internet hosting huge rip-off operations. In some accommodations above casinos there, blocks of visitor rooms have been transformed into workplaces the place staff assist fraudsters discover motorcades to maneuver illicit funds, in line with a 2024 report by a doctoral anthropology scholar.

Credit score:

Cindy Liu for ProPublica

Inside these workplaces, the faucet of keyboards and buzz of Telegram notifications urged a buying and selling ground at a inventory alternate. However the work of the individuals interviewed by Yanyu Chen, the doctoral scholar, was very totally different. The employees, all Chinese language and talking on the situation of anonymity, have been candid. They stated they have been tasked with matching cyberscam gangs with suppliers who might provide them with financial institution accounts to gather and transfer proceeds from fraud victims. In Telegram discussion groups, the employees might see checking account suppliers and swindlers in want of accounts and would match the 2 and hold monitor of trades and commissions.

The enterprise has turn out to be so mainstream that even certainly one of Cambodia’s most outstanding monetary companies corporations, Huione Group, runs a web based market that allegedly facilitates such transactions. Its Telegram channels, together with the one which included the aforementioned advert providing “firsthand” management of U.S. financial institution accounts, have helped launder funds for pig-butchering scams in addition to heists linked to North Korea, in line with the U.S. Treasury’s Monetary Crimes Enforcement Community. (Huione stated in an announcement that it’s working to stop abuse of its companies and is “absolutely dedicated to collaborating with the U.S. Treasury Division to deal with expeditiously any and all considerations.”)

The employees interviewed by Chen have been unperturbed about enabling fraud. One described the work as boring, little greater than copying and pasting checking account information between scammers and motorcades. One other employee advised her that he considered himself as “fixing a really previous drawback of stepping into the banking system individuals who have lengthy been shut out of it.”

The fraud that ensnared Middlesex Truck and Coach as a tangential sufferer lined hundreds of miles through digital byways. By all appearances, it emanated from Cambodia, then reached New Jersey, the place a mark was persuaded to wire a complete of $716,000 to accounts tied to purported companies in Boston, New York, California, Hong Kong and elsewhere. All however a couple of appeared to have been integrated by Chinese language people, generally simply days earlier than their accounts began accepting giant sums.

The fleecing of Kevin, who ProPublica agreed to determine by first identify solely, was a textbook instance of pig butchering. Kevin had reached the stage in life when he wished to ease his workload after a various profession as a monetary planner, small-business proprietor and health teacher. Simply earlier than Christmas 2022, somebody purporting to be a San Diego girl named Viktoria Zara friended Kevin on Fb. She quickly launched him to a modern crypto buying and selling web site known as 3A on which she claimed to have made $700,000 on bitcoin futures. (Fb deactivated Zara’s profile after ProPublica inquired about it, and a spokesperson stated the social media firm has “detected and disrupted over seven million accounts related to rip-off facilities” in Asia and the Center East because the begin of 2024.)

Kevin acknowledges he was seduced by the thrall of straightforward cash. “One thing came to visit me,” he stated. Kevin accepted Zara’s supply to show him how one can commerce and, inside a couple of weeks, he was routinely wiring tens of hundreds of {dollars} to varied financial institution accounts to fund his buying and selling.

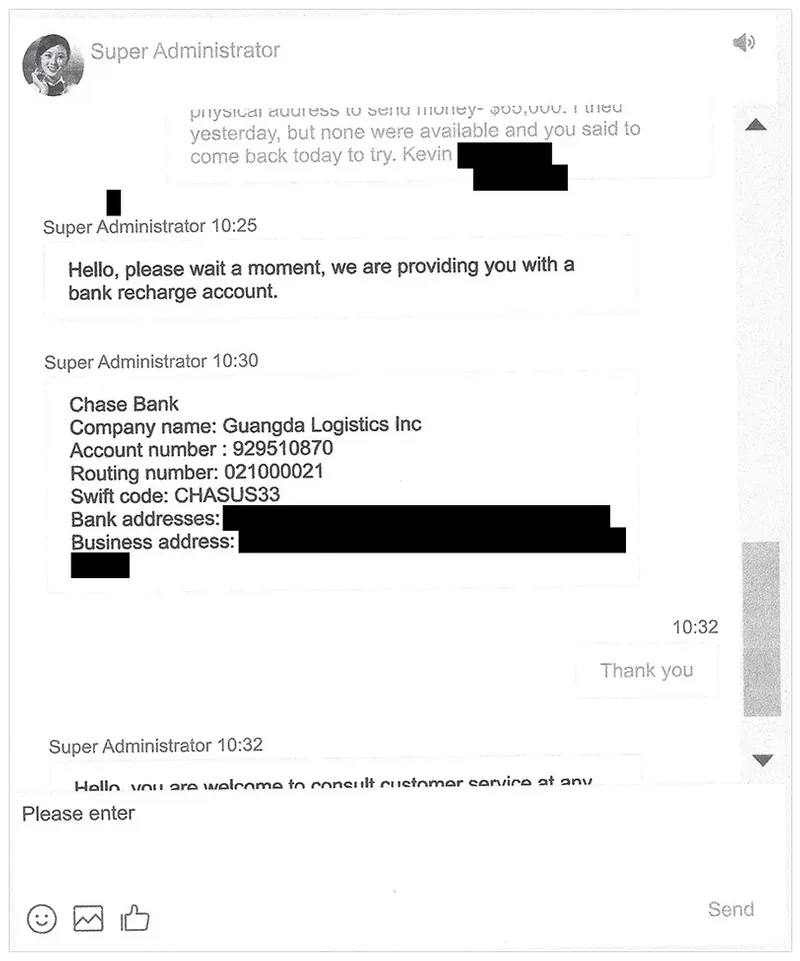

The accounts weren’t registered to 3A. They have been listed underneath a wide range of firms he’d by no means heard of, comparable to Guangda Logistics and Danco World.

Kevin discovered this odd. However Zara, his supposed pal, advised him that was simply how 3A operated, and Kevin felt protected wiring funds to accounts at Chase due to its dimension and popularity. Each time he did so, the sum confirmed up in his on-line 3A portal, making him suppose the transactions have been actual. Higher but, his investments had apparently soared; his account stability now learn $1.4 million.

Credit score:

Courtesy of Kevin. Redacted by ProPublica.

Like many a pig-butchering sufferer, Kevin realized one thing was off solely when he went to withdraw his earnings and 3A demanded that he first pay a “tax” of virtually $134,000. Kevin knew from his monetary planning days that wasn’t how issues labored. However he put aside his doubts and went to his financial institution late one afternoon in April 2023 to wire the tax cost. He’d been given a contemporary Chase account to ship funds to and pressured to wire cash inside two hours.

This time, his cash was addressed to Middlesex Truck and Coach. Kevin was so underneath the sway of his scammers at that time that he didn’t query the cash’s vacation spot. Nor did the teller on the TD Financial institution department he went to. (TD declined to touch upon Kevin’s case however stated it trains workers to problem prospects when transactions appear suspicious and to warn them by no means to wire funds to individuals they have no idea.)

As quickly as Kevin received residence, panic set in: 3A advised him the Chase account to which he’d simply wired $134,000 was frozen and that his tax cost wouldn’t undergo. He would wish to ship one other $134,000 to a special account. Confused, Kevin went again to TD very first thing the following day and requested the teller to reverse the wire. Over the following two weeks, Kevin stated, his bankers at TD known as Chase thrice however by no means received a response. (Chase didn’t reply ProPublica’s questions on Kevin’s efforts to recall his wire however stated the wire recall course of is difficult and barely succeeds.)

It’s potential to reverse a wire switch if prospects inform their banks rapidly, earlier than the transaction has been accomplished, in line with attorneys and specialists. However banks have no obligation to reverse a switch even when a buyer studies potential fraud. “It’s actually as much as the receiving establishment in the event that they launch the funds and the way they go after the client on their finish,” stated Saskia Parnell, a banking business veteran who now volunteers for an anti-scam group known as Operation Shamrock.

As Kevin agonized, the 3A customer support reps dangled an answer: Simply wire the funds once more and unlock your $1.4 million. He feared TD wouldn’t let him ship the wire once more, so he switched to PNC Financial institution and despatched a contemporary $134,000 wire to a different recipient at Cathay Financial institution in California. That yielded one more story a few purported authorities roadblock and the demand for one more cost.

Kevin wasn’t pondering clearly. His son, who had struggled with substance abuse, had instantly died of a fentanyl overdose. Kevin was overwhelmed with grief. He agreed to make one other cost.

By June 2023, even a name from PNC’s fraud division declining his outgoing wire couldn’t dissuade him. It was the one occasion, out of the 11 instances he tried to wire cash to scammers, {that a} financial institution stopped the transaction, in line with Kevin, who didn’t have a historical past of constructing wire funds earlier than. (PNC stated in an announcement that “we imagine we took applicable motion.”)

It made no distinction. Kevin’s thoughts was so clouded that he as a substitute opened a brand new account at Wells Fargo. The swap illustrated one other problem: Even when one financial institution succeeds in stopping fraud, criminals can nonetheless win if one other financial institution isn’t as diligent. (Wells Fargo stated it invests a whole lot of tens of millions of {dollars} a yr to combat scams).

After wiring $150,000 from Wells Fargo to 2 Chinese language entities listed at a Singaporean financial institution, Kevin waited to obtain his buying and selling proceeds. However when all that resulted was one other request that he wire cash — $40,000 this time — Kevin lastly grasped actuality. He was now with out a son, and his funds lay in ruins. “The entire world was coming to an finish,” he recalled.

Kevin had preserved sufficient financial savings to rent a personal investigator, John Powers of Hudson Intelligence, to observe the monetary path. Powers discovered a litany of crimson flags among the many entities that had gotten financial institution accounts and acquired Kevin’s funds. A number of the companies gave phony addresses, comparable to a vacant residence. One other was registered to a one-bedroom house in Los Angeles that was additionally listed because the headquarters of a dozen different companies arrange since 2022 by totally different Chinese language people. Contact information was scarce; official emails for 2 firms included the non permanent e mail area “netsmail.us,” which doesn’t connect with a functioning web site. All of those ersatz companies had accounts at Chase, Cathay or Singapore’s DBS Financial institution.

Chase stated that it has insurance policies to determine and confirm the identities of its prospects, and that it regularly evaluates and enhances them. Cathay stated it additionally evaluations its techniques and insurance policies to detect and stop fraudulent exercise. DBS didn’t reply to requests for remark.

One other clue indicated that the banks had been doing enterprise with a bigger legal enterprise. Two of the businesses Kevin despatched funds to, Guangda Logistics (which lists no contact data) and Danco World (which didn’t reply to ProPublica’s request for remark), confirmed up on a listing of greater than six dozen shell entities that had been used to defraud People of practically $60 million. The knowledge was uncovered in an investigation by the U.S. Secret Service into KG Pay, one of many cash laundering teams that was on Telegram.

Credit score:

Christopher López for ProPublica

The case of the person behind KG Pay sheds additional gentle on how motorcades use U.S. banks. Daren Li, a Chinese language nationwide in his early 40s, glided by the alias KG Excellent. Based mostly in Cambodia, he directed the motion of huge sums of pig-butchering proceeds from the U.S. to abroad. Li, who was arrested in April 2024 on the airport in Atlanta, pleaded responsible in November to conspiracy to commit cash laundering. He admitted that a minimum of $73.6 million of sufferer funds have been deposited into financial institution accounts he and his co-conspirators managed. Li, who’s in federal detention awaiting sentencing, couldn’t be reached for remark via his lawyer. Seven different individuals have pleaded responsible to conspiring with Li.

KG exploited a weak point within the U.S. banking system: Banks are reluctant to share account data, even after they’ve recognized suspicious exercise. A legislation enacted within the wake of the Sept. 11, 2001, assaults gave banks a reprieve from secrecy guidelines in the event that they alert each other to potential terrorism or cash laundering actions. However the data sharing is voluntary and “banks should not speaking with one another,” in line with Matt O’Neill, who led many cash laundering investigations for the U.S. Secret Service throughout his 25 years there. “Fraudsters understand it and fraudsters are clearly making a whole lot of tens of millions or billions of {dollars} off of this obtrusive hole within the system,” stated O’Neill, who now runs 5OH Consulting.

One of the crucial prolific cogs in Li’s motorcade, in line with civil and legal circumstances, was a Chinese language nationwide named Hailong Zhu. He entered the U.S. on a vacationer visa round 2019 after which stayed, working odd jobs in development and at a restaurant. In 2022, Zhu was recruited to assist Li’s different operatives arrange companies and financial institution accounts close to Los Angeles in alternate for $70,000.

Zhu turned the task right into a full-time job, ultimately juggling seven accounts at Financial institution of America, Chase, East West Financial institution and Wells Fargo tied to 2 entities arrange in his identify: Sea Dragon Buying and selling and Sea Dragon Transform. When Financial institution of America restricted Zhu’s Sea Dragon Buying and selling account attributable to suspected fraud on Oct. 19, 2022, Zhu received one other account at Financial institution of America the following day utilizing Sea Dragon Transform. By Nov. 1, 2022, he had secured 4 extra accounts at Chase, Wells Fargo and East West Financial institution. Apart from various his handle and e mail, investigators discovered that Zhu offered largely the identical information when opening accounts for the 2 shell entities.

Zhu’s account opening spree occurred only a few months after federal prosecutors blamed “the corruption of BofA bankers” for a scheme by which a handful of workers opened 754 accounts at Financial institution of America registered to 13 false addresses within the Los Angeles suburbs. In that case, shadowy middlemen allotted bribes of $200 to $250 per account to Financial institution of America workers who overrode inner compliance techniques to open accounts for abroad Chinese language residents who weren’t bodily current on the department to open the accounts, in violation of the financial institution’s guidelines. Even when the bankers registered 176 prospects to at least one small residence, the accounts have been nonetheless opened. (Two of the bankers later pleaded responsible to creating false entries in financial institution data; Financial institution of America stated in an announcement that it “uncovered criminality utilizing its monitoring techniques, terminated the workers, and cooperated with legislation enforcement, who efficiently prosecuted these concerned. That is how our anti-money laundering program is designed to work.”)

With banks at all times one step behind, Zhu’s accounts stored receiving a whole lot of hundreds of {dollars} from victims throughout the U.S. Zhu would bundle the proceeds and switch them overseas. Throughout one week in November 2022, for instance, he acquired six wires totaling virtually $52,000 into certainly one of his accounts and wired out one lump sum of $53,000. The vacation spot was a checking account within the Bahamas managed by Li and others, who transformed the funds into cryptocurrency for his or her journey to rip-off facilities positioned abroad, together with in Sihanoukville. Investigators found a crypto pockets handle they believed Li managed. Information from cryptocurrency analytics agency Crystal Intelligence reveals the pockets handle despatched and acquired about $341 million of crypto throughout 16,800 transactions between April 2021 and April 2024.

Zhu was arrested in March 2023 and charged with financial institution fraud. His attorneys acknowledged at trial that their consumer opened financial institution accounts and moved funds however stated that Zhu didn’t know his bosses have been utilizing them for legal functions. Zhu was acquitted after the attorneys persuaded the trial choose that utilizing false data to acquire a checking account doesn’t represent a scheme to defraud a financial institution. Solely months after the acquittal, Zhu was charged once more, this time with cash laundering offenses, in an indictment filed in December 2023. Zhu, who couldn’t be reached for remark, didn’t enter a plea and was listed as a fugitive as of March 2025.

In January 2024, Kevin, determined to get his a reimbursement, sued the ten firms to which he had wired cash on the scammers’ behest, together with Middlesex Truck and Coach. None replied to his lawsuit — most have been shell entities, in spite of everything — till January 2025, when Kevin’s lawyer received an e mail from Brian Maloney Jr.

Maloney confessed that his workers had ignored the lawsuit when it was initially served as a result of it regarded like a rip-off. He stated he’d by no means banked with Chase and had no concept about any account that had been used to defraud Kevin. Maloney agreed to go to the native Chase department to research and attempt to assist Kevin get his a reimbursement.

“I went to the financial institution and stated, ‘What the hell is occurring?’” Maloney advised ProPublica. After spending practically two hours with the native Chase department supervisor, Maloney realized that he, too, was a sufferer of the financial institution’s lax procedures: He stated the department supervisor advised him that Chase had allowed somebody to acquire an account on-line in his firm’s identify in March 2023 with nothing greater than a digital signature and an employer identification quantity, however no private identification. That account had then accepted a whole lot of hundreds of {dollars} of wire transfers. And now Maloney’s household enterprise — not Chase — was the defendant in a lawsuit. “How is that this authorized?” he questioned. (Colin Schmitt, a retired FBI agent, stated Chase might have mitigated the fraud by a minimum of pausing incoming wire transfers to the pretend Middlesex account and asking its proprietor to justify the transactions. “When you’re simply utilizing an account only for wires, that’s an enormous crimson flag,” Schmitt stated.)

Nonetheless, there was a silver lining: The funds remained within the account. Not solely Kevin’s $134,000, however virtually $100,000 extra from a number of different victims sat frozen inside since spring 2023.

Kevin was glad the cash was nonetheless there, however he questioned why it took a lawsuit to unearth the information. “It doesn’t appear to be the system is tailor-made to provide any deference to the sufferer,” he stated. “That’s what frustrates me.” His attorneys suggested him to hunt an order from a federal choose to get his funds again and filed such a petition in March. After ProPublica requested Chase about Kevin’s funds in April, the financial institution agreed to return the cash to him with out a court docket order.

The $134,000 landed again in Kevin’s checking account in mid-Might. Lastly, he felt a way of aid. (He has now dropped the go well with in opposition to Middlesex.) However Kevin additionally questioned what would occur to the opposite individuals whose cash received siphoned up by the pretend Middlesex account. Would Chase anticipate them to file lawsuits too?

Banks are beginning to face lawsuits by pig-butchering victims who allege laxness in opening accounts. In December, a California man who was defrauded of practically $1 million sued DBS and two different banks for alleged failures to adjust to know-your-customer and anti-money-laundering legal guidelines. A university professor from Iowa who misplaced $700,000 filed a lawsuit in January in opposition to Cling Seng Financial institution in Hong Kong for failing to do correct due diligence on the individuals who opened accounts used to defraud him. Cling Seng reached an settlement with the Iowa professor to dismiss the go well with and declined to remark additional. DBS didn’t reply to requests for touch upon the California case, however the financial institution asserted that the lawsuit accommodates “deadly flaws,” in line with a submitting within the go well with.

Such circumstances are lengthy photographs, in line with Carla Sanchez-Adams, senior lawyer on the Nationwide Shopper Legislation Middle. The fits usually fail as a result of it’s laborious to indicate that monetary establishments knew or ought to have recognized about potential fraud.

Nonetheless, banks are nicely conscious that fraud is on the rise. Almost 1 in 3 People say they’ve been the sufferer of on-line fraud or cybercrime, in line with a 2023 ballot commissioned by Wells Fargo. “The dimensions of fraud happening on daily basis is an enormous burden for our nation and for the tens of millions of hard-working men and women whose lives are affected by it,” Rob Nichols, president of the American Bankers Affiliation, stated in an October speech.

Nichols contends that “customers credit score the banking business with doing greater than different industries to guard them from fraud and hold their data protected.” He cited an initiative by the ABA to create a database of fraud contacts to assist banks work out who to name when there’s an issue. And he urged the Trump administration to develop a nationwide fraud prevention technique.

Different international locations are taking extra aggressive steps. In October, the U.Okay. started requiring banks to reimburse rip-off victims as much as £85,000, or about $116,000, per declare after they make a fraudulent cost on behalf of their prospects, even when the purchasers approved the switch. Australia lately enacted a legislation that may require banks to share suspect account information with each other. Thailand has gone even additional, making a Central Fraud Register meant to compel banks to determine and shut accounts used for cash laundering.

The U.S. lacks such guidelines. O’Neill, the previous Secret Service agent, thinks that updating the Patriot Act, the post-9/11 legislation meant to encourage banks to share intel, can be an excellent place to begin. However Congress has not moved in that course and the Trump administration has proven no signal that it plans to prioritize this challenge. (Requested what steps the administration is taking, a spokesperson advised ProPublica to Google the administration’s sanctions associated to pig-butchering scams.)

For now, financial institution accounts stay straightforward for fraudsters to acquire. A sleek-looking brokerage akin to 3A has been on-line for months, soliciting deposits for what a researcher on the World Anti-Rip-off Group recognized as a pig-butchering scheme. Anybody wishing to “make investments,” the brokerage stated, can wire cash to a shifting array of banks, together with Chase.

Doris Burke contributed analysis.